The Best Moving Average For Day Trading

The best moving average for day trading is the SMA which is short for simple moving average. The simple moving average is the best because it is the most reliable and accurate for finding the actual average price, finding established trends, knowing where price should react and showing you areas where price needs to take control of in order for a reversal to happen.

There are many different moving averages you can use such as SMA, EMA, HMA, VWMA, WMA and RMA and each one has its own strengths and weaknesses. You can test each one of these moving averages yourself easily by using our Any 8 Moving Averages indicator on Tradingview. Let’s take a look at each one in depth and how their values are calculated so you have a full understanding of the tools you are using when day trading.

How Moving Averages Are Calculated

Moving Averages are technical indicators that are calculated using a source value and a length. The source value can be any of the following values, which provide a specific price for each candle on the chart.

Source Values You Can Use

- Close

- Open

- High

- Low

- hl2 – (high + low) / 2

- hlc3 – (high + low + close) / 3

- hlcc4 – (high + low _ close + close) / 4

- ohlc4 – (open + high + low + close) / 4

Lengths Or Number Of Candles To Calculate

The second part of the calculation for each moving average is the length which means the number of previous candles that will be used to calculate the moving average from. Some of the most popular lengths are 5, 8, 13 and 20 for short term moving averages which are typically used by scalp traders.

Longer term moving average traders typically use lengths such as 50, 100, 200 and 500. The lengths you use are up to you and what you prefer based on your style of trading.

Using the length of your choice and the source you have set, the calculation for a simple moving average is as follows:

SMA = (sum of the source value for a number of bars) / number of bars

So for example if you are using the close price as your source and a 20 period length, then you will take the last 20 bars closing price and add them together. Then you will divide the sum of those values by the period of time(length).

That is the basic formula for a simple moving average, but other moving averages are calculated based on the same principle, but with a small change depending on the type of moving average.

Simple Moving Averages - SMA

Pros

The best part about simple moving averages is that they are reliable and accurate which is the most important part of trading. Accuracy is key when trading because it helps you enter and exit trades at the most reliable points which helps reduce drawdown and maximize your wins.

Cons

Simple moving averages are a little slower to react than EMAs or HMAs because of how they are calculated.

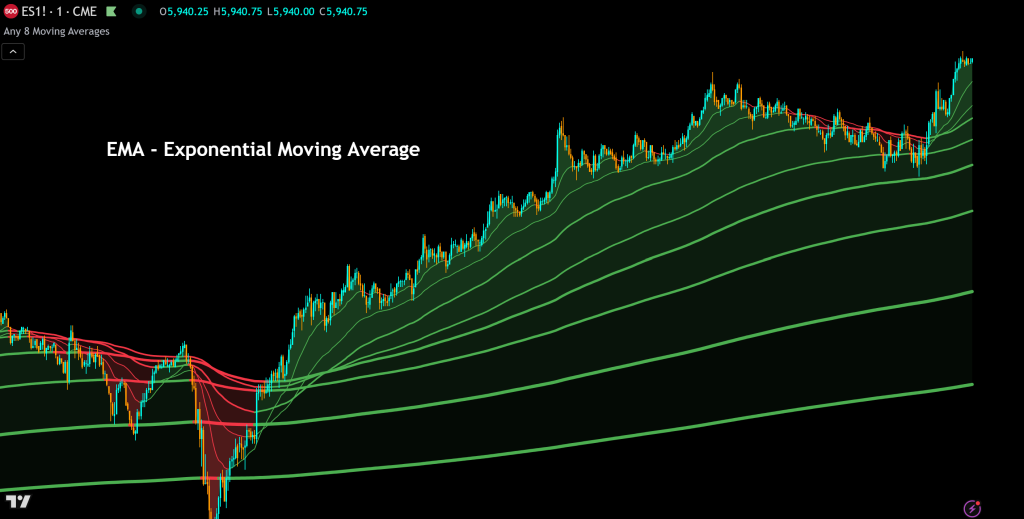

Exponential Moving Averages - EMA

Pros

Exponential moving averages are weighted more heavily with the most recent bars, so they will react faster than SMAs and some other moving averages. The quick reaction can help get you into and out of positions earlier which is why they are such a popular choice for day traders, scalpers and swing traders.

Cons

The quick reaction provided by EMAs comes with the downfall of not being as reliable as an SMA. Reliability is more important than quick reaction because entering trades too early can mean taking more losses.

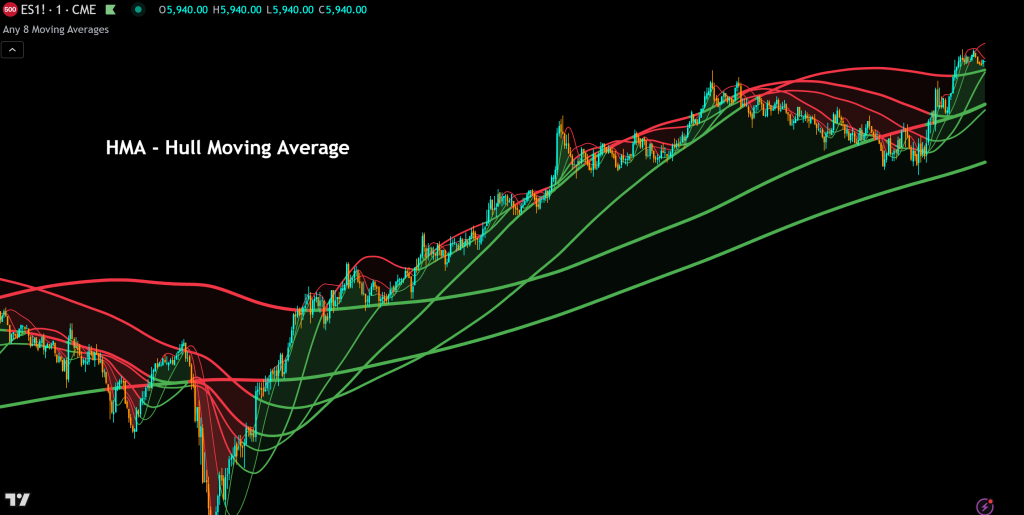

Hull Moving Averages - HMA

Pros

Hull moving averages have some of the fastest reaction times because it uses a custom formula that is based on a weighted moving average formula. This moving average will be even more responsive than the EMA and helps to catch the earliest entries and exits.

Cons

Due to how responsive the HMA is, it will give more false readings than other moving averages.

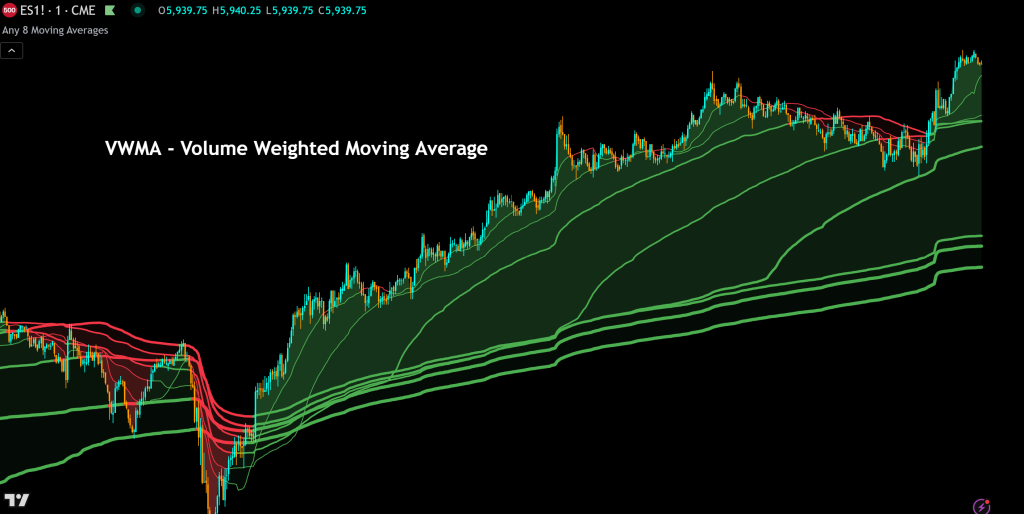

Volume Weighted Moving Averages - VWMA

Pros

Volume weighted moving averages are excellent for trading because they take volume into account. Volume plays a major role in how and when price will react, so the VWMA can help improve the reliability of moving averages.

Cons

Due to volume being such a big factor in the calculation of this moving average, it can be very slow to react and will not provide early entries of exits from positions.

Weighted Moving Averages - WMA

Pros

Weighted moving averages will weigh the most recent bars heavier to help it react more quickly, which can be very useful in helping traders get into and out of positions at ideal times.

Cons

The downside to this moving average is that its responsiveness provides more false readings and it also does not react as quickly as an exponential moving average.

Relative Moving Average - RMA

Pros

Relative moving averages are much smoother than normal moving averages, which makes them easier to read on your charts and usually more reliable for finding good entry points.

Cons

The smoothness of these RMAs can also mean that they react slowly and will not give you very early entries or exits which can increase the risk for your trades.

Increasing The Reliability Of Your Moving Average

You can get the best of multiple different moving averages by combining them together into one moving average. If you don’t have the knowledge to program this yourself, we built a combined moving average indicator that you can use for free on Tradingview.

It combines the SMA, EMA, WMA, VWMA, HMA and RMA together to give you one smoothed out moving average that still reacts quickly, but is also reliable. It has become a very popular indicator on Tradingview for those reasons.

Moving Average Trading Strategies

There are a few different ways that you can use moving averages to help you trade.

The first one we recommend is using longer term moving averages such as the 50, 100 and 200 and trading trending markets. You can do this by waiting for price to establish a trend and then buying when price comes back to the long term moving averages and then selling the position when price action starts trending again and then breaks below the 50 moving average.

Another way to trade with moving averages is using very long lengths such as the 200, 500 and 1000 length SMA and then buying the dip when price comes all the way back to those long term moving averages and bounces.